The Wall Street Journal published an op-ed by Phil Gramm and Mike Solon pushing “pro-growth tax reform” and criticizing “regulatory burden” and “antibusiness bias.” The Journal did not disclose that the authors are partners of an anti-regulation lobbying firm, and that Solon is frequent business lobbyist.

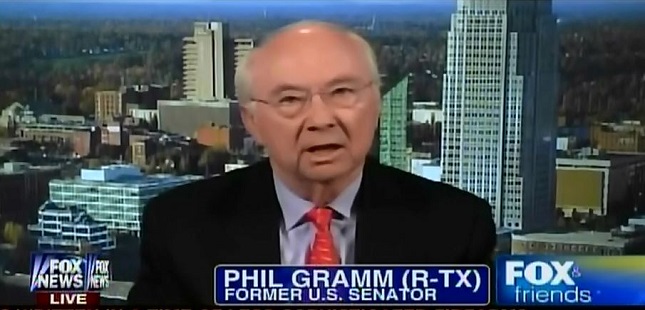

Gramm is a former Republican Senator, and Solon worked as a Gramm Senate staffer for over a decade. They run Gramm Partners, a D.C. lobbying firm. The firm's website states that it works “on the issues that matter most to financial companies” and has “a track record of delivering major accomplishments -- and stopping bad deals in their tracks.” The two also run US Policy Metrics, “an economic and public policy research firm serving asset managers, hedge funds and the investor community.”

According to 2013 data (the most recent available), Solon has lobbied for a variety of clients including the “lobby giant” Akin Gump, Fidelity, American Express, Mortgage Insurance Companies of America, Exxon Mobil, and US Chamber of Commerce. In addition to heading a lobbying firm, Gramm gained notoriety during the 2008 campaign because he co-chaired Sen. John McCain's presidential campaign and was also a “lobbyist for a Swiss bank at the center of the housing credit crisis.” Gramm does not appear to have registered as a lobbyist since 2007. Gramm Partners' lobbyist registration form states it is lobbying on behalf of Akin Gump on issues that include budget and taxes.

The Journal's identification of Gramm and Solon simply states: “Mr. Gramm, a former chairman of the Senate Banking Committee, is senior partner of US Policy Metrics and a visiting scholar at the American Enterprise Institute. Mr. Solon was a policy adviser to Senate Republican Leader Mitch McConnell and is a partner at US Policy Metrics.”

Gramm and Solon's op-ed complains that Democrats won't lower tax rates and have a “misplaced perception of the importance of the inequality debate.” They added: “A pro-growth tax reform will not undo this administration's doubling of the federal debt held by the public, its tax increases, increased regulatory burden or antibusiness bias. But it would be a major movement in the right direction.”

Media Matters has documented how the Journal has repeatedly failed to disclose relevant ties about writers in its editorial page.