Numerous conservative media outlets are scamming their followers with paid promotions for dubious marijuana stocks. In one instance, a promoted stock had its trading temporarily halted and was part of an FBI-investigated pump-and-dump scheme. In another, fine print acknowledged the promoters had “a direct conflict of interest” that would “negatively” affect “your shares.”

Erick Erickson's RedState, Dick Morris, Newsmax, Townhall, and Human Events have all recently pushed the shady investments.

Readers who took the financial advice would have made a bad call as the stocks have plummeted. For example, conservatives sent sponsored emails recommending a company called MediJane at an entry point of $0.85. The stock's closing price on December 2 was $0.03. Dick Morris sent a sponsored email promoting Cannabis-Rx, Inc. on April 14, when it was trading at around $1. The stock's closing price on December 2 was $0.17.

Politico recently reported that pot companies “are a new vehicle for stock scammers promising big returns,” prompting federal and state agencies to investigate stock manipulations. Scrutiny is focusing “on pump-and-dump schemes, which involve attempts to inflate a company's share price and then sell, or dump, the stock before unsuspecting investors get wise to the scheme.” The schemes are more likely to target “penny stocks,” which the Securities and Exchange Commission (SEC) defines as “a very small company that trades at less than $5 per share.” Penny stocks are traded over-the-counter instead of on formal exchanges such as the New York Stock Exchange.

The SEC issued an investor alert in May warning that “fraudsters” are using penny pot stocks “to lure investors with the promise of high returns.” It cautioned that red flags include “E-mail and fax spam recommending a stock” and “SEC trading suspensions” -- both characteristics of the conservative-promoted stocks.

These shady stock promotions are part of a larger trend of conservatives scamming their followers for profit. Fox Business host Charles Payne was paid to promote now virtually worthless penny stocks. Tobin Smith sent paid promotions for stocks that ended up tanking; he was eventually fired from his position at Fox News for the practice. And Fox News host Mike Huckabee sent sponsored emails touting Smith's recommendation of Gray Fox Petroleum (GFOX); GFOX's price has since tanked and is now trading at a near 52-week low.

Below is a look at two recent marijuana stocks that conservative media promoted to followers.

MediJane Holdings

MediJane states it provides “medical delivery systems for the treatment of targeted illnesses using cannabinoids.” Conservative outlets such as Erick Erickson's RedState.com, Townhall.com, Human Events, and Newsmax's Moneynews.com sent sponsored emails claiming the stock could beat gains of “768%.” Conservatives sent the emails despite small print acknowledging the promoters have “a direct conflict of interest” that “negatively” affects “your shares.”

The emails were written by “the UnderValued Quarterly Newsletter” on behalf of Globalvision Communications LLC. On May 14, Erickson's subscribers received a pitch telling them: “As impressive as those 768%...381%... 592% gains are, MediJane (MJMD) could outperform all of them over the coming months. One thing's fairly certain: MJMD belongs in your portfolio today!” A link on the email sends readers to a “report” claiming the stock “could climb from” its “current price” of "$0.85 to $3.00 and turn $5,000 into $17,646 and make you more than 3 times richer within a short time!"

The stock has sunk to $.03 as of closing on December 2. Readers who put $10,000 of MJMD at the entry price of $0.85 would only have approximately $353 on December 2.

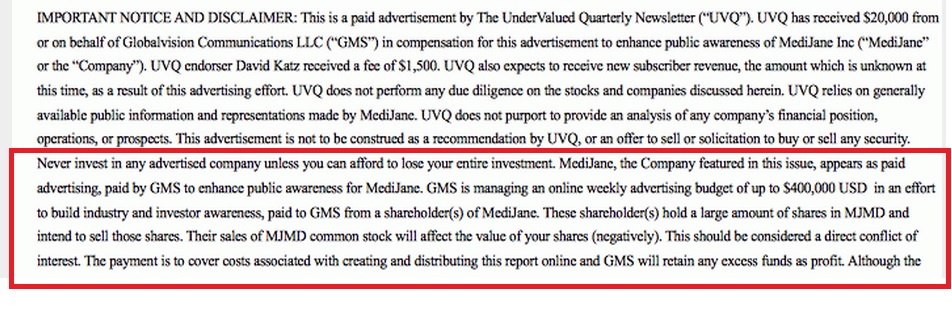

Small print on the sponsored emails includes a disclaimer indicating the email's fraudulent nature. It states that Globalvision is managing a “weekly advertising budget of up to $400,000 USD in an effort to build industry and investor awareness, paid to GMS from a shareholder(s) of MediJane. These shareholder(s) hold a large amount of shares in MJMD and intend to sell those shares. Their sales of MJMD common stock will affect the value of your shares (negatively). This should be considered a direct conflict of interest.” In other words, the people funding the promotion are planning to do the opposite of what they're recommending. From the disclaimer:

Cannabis-Rx, Inc.

Cannabis-Rx is a company that claims to provide “cannabis-based businesses with capital and real estate opportunities to enhance operations and facilitate growth.” In September, the FBI found that fraudsters used the stock in a pump-and-dump scheme.

The FBI announced it indicted six individuals for “Fraudulent Manipulation Schemes of Publicly Traded Companies, Including Cannabis-Rx Inc.” The Wall Street Journal reported of the charges:

The undercover operation included wiretaps on five phones that captured real-time evidence of an alleged pump-and-dump scheme earlier this year. Prosecutors said the scheme sent the share price of Cannabis-Rx Inc. plummeting from $13.77 to 50 cents in less than a month. Llorn Kylo, chief executive of Cannabis-Rx, a real-estate firm based in Scottsdale, Ariz., that specializes in the regulated cannabis industry, said the company “and its law-abiding shareholders are victims of this alleged scheme.” Cannabis-Rx hasn't been accused of any wrongdoing.

Dick Morris helped promote the Cannabis-Rx stock in an April 14 email titled “How You Can 'Cash-in' on the Cannabis Boom” from “our paid sponsor, Mike Casson, Publisher & Executive Editor of MicroCap MarketPlace.” Casson claimed to have “discovered a relatively unknown company in this red-hot industry that could provide you with an opportunity for fast-moving, explosive profits. ... Right now is your chance to grab a piece of this red-hot industry while this megatrend is still in its early stages -- when the juiciest profits are still there for the taking.”

The email asked: “How Much Money Can Be Made by Investing in Legal Marijuana Stocks?” Not much, at least with Cannabis-Rx. The stock price was at just $0.17 at closing on December 2. If DickMorris.com readers bought $10,000 worth of the stock at the end of trading on April 14 at $0.96, they'd have approximately $1,771 on December 2.

Despite these repeated failures, conservatives continue to send sponsored solicitations for marijuana penny stocks. Since October, Morris, Newsmax, National Review, and Michael Reagan have sent sponsored emails touting Earth Science Tech, Inc., a “strong buy” at $2 a share with a long term price target of "$28.31 - $42.76."