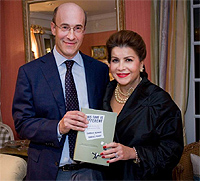

A wide swath of media figures have cited economists Carmen Reinhart and Kenneth Rogoff's January 2010 finding that a country's economic growth becomes impaired when its debt level exceeds 90 percent of gross domestic product. But the Reinhart-Rogoff paper is premised on an Excel error, revealed when other researchers reviewed the data underlying the commonly-cited debt-to-GDP threshold claim.

A wide swath of media figures have cited economists Carmen Reinhart and Kenneth Rogoff's January 2010 finding that a country's economic growth becomes impaired when its debt level exceeds 90 percent of gross domestic product. But the Reinhart-Rogoff paper is premised on an Excel error, revealed when other researchers reviewed the data underlying the commonly-cited debt-to-GDP threshold claim.

Austerity proponents, such as House Budget Chairman Paul Ryan (R-WI), frequently claim that a debt-to-GDP ratio of 90 percent signals economic doom, using Reinhart and Rogoff's work as leverage for imposing sharp cuts that economists agree would do serious harm to economic growth. Media coverage of budget and economic policy throughout the past three years has also repeated that claim, often without a direct connection to the Reinhart-Rogoff work from which the notion derives.

But that work, arguably the lynchpin of the case for imposing austerity in order to deliver economic growth, is crippled by basic errors, as the Roosevelt Institute's Mike Konczal explains:

From the beginning there have been complaints that Reinhart and Rogoff weren't releasing the data for their results (e.g. Dean Baker). I knew of several people trying to replicate the results who were bumping into walls left and right - it couldn't be done.

In a new paper, “Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff,” Thomas Herndon, Michael Ash, and Robert Pollin of the University of Massachusetts, Amherst successfully replicate the results. After trying to replicate the Reinhart-Rogoff results and failing, they reached out to Reinhart and Rogoff and they were willing to share their data spreadhseet. This allowed Herndon et al. to see how how Reinhart and Rogoff's data was constructed.

They find that three main issues stand out. First, Reinhart and Rogoff selectively exclude years of high debt and average growth. Second, they use a debatable method to weight the countries. Third, there also appears to be a coding error that excludes high-debt and average-growth countries. All three bias in favor of their result, and without them you don't get their controversial result. [...]

So what do Herndon-Ash-Pollin conclude? They find “the average real GDP growth rate for countries carrying a public debt-to-GDP ratio of over 90 percent is actually 2.2 percent, not -0.1 percent as [Reinhart-Rogoff claim].” Going further into the data, they are unable to find a breakpoint where growth falls quickly and significantly.

Rogoff and Reinhart responded to the criticism, which has since been criticized as a weak rebuttal. But now that those numbers are known to be wrong, the litany of media outlets which have cited them have an opportunity to reexamine their coverage of the austerity premise. Print media, notably The Weekly Standard, The Washington Post, San Francisco Chronicle, and Atlanta Journal-Constitution, have frequently reproduced the Reinhart-Rogoff thesis in covering budget and economic policy. Television and radio media have made frequent use of the Reinhart-Rogoff paper, including prominent mentions on NPR, CNN, and Fox Business.

The Reinhart-Rogoff threshold has long been challenged by fellow economists, such as former Federal Reserve economist Joseph Gagnon, Paul Krugman, and Josh Bivens and John Irons of the Economic Policy Institute, on the grounds that it gets the directionality of causation exactly wrong. These and other economists argue that high debt levels are a consequence of prolonged weak GDP growth, rather than its cause.

As the Center for Economic and Policy Research's Dean Baker notes, however, the newly discovered errors obviate these more intricate economist responses to Reinhart-Rogoff: “we need not concern ourselves with any arguments this complicated. The basic R&R story was simply the result of them getting their own numbers wrong."