Conservative media are attempting to deflect attention from the revelation that GOP presidential candidate Donald Trump took a $916 million loss in 1995 that might have allowed him to avoid paying federal income taxes for 18 years by saying that that Democratic nominee Hillary Clinton and former president Bill Clinton did “the same thing” by claiming a “$700,000 loss” on their 2015 tax return. The claim, which originated with a pseudonymous Reddit poster and has already spread to Fox News, fails to note that while the Clintons’ 2015 return shows that they did have a roughly $700,000 capital loss carried over from a prior year, that loss originates with the financial crash of 2008, and they received only a $3,000 deduction for those losses and paid $3.2 million in federal income taxes in 2015.

The New York Times reported October 1 that after declaring “a $916 million loss on his 1995 income tax returns,” Trump may have “legally avoid[ed] paying any federal income taxes for up to 18 years,” according to tax documents the paper obtained. Utilizing “tax rules especially advantageous to wealthy filers,” writes the Times, Trump could have used the massive “financial wreckage he left behind in the early 1990s” to “cancel out an equivalent amount of taxable income over an 18-year period.” The Trump campaign has struggled to explain the revelation, but it has not denied the suggestion that Trump avoided paying nearly two decades of federal income tax.

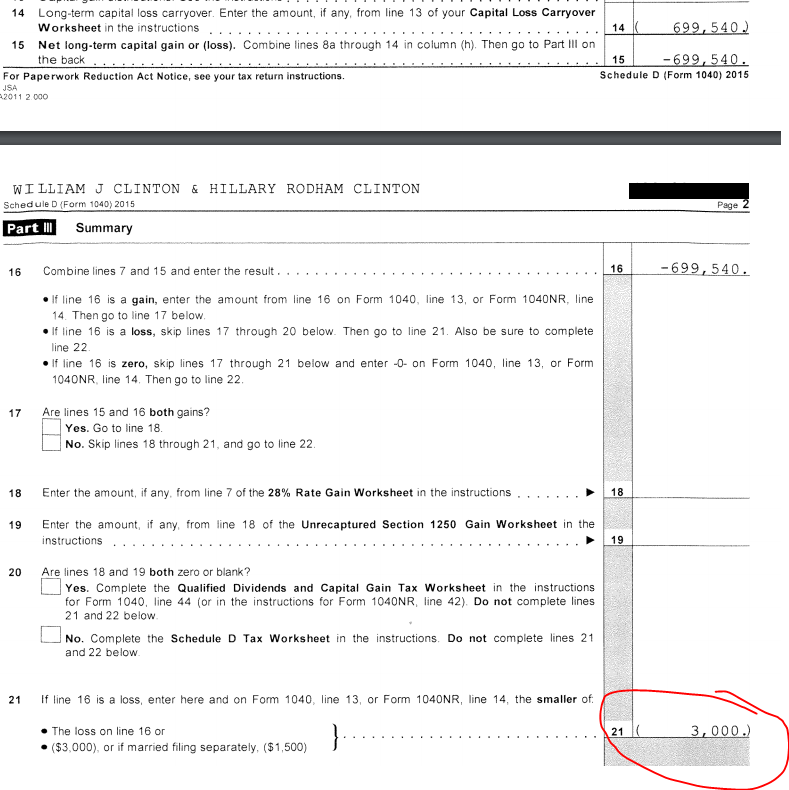

Last night, Reddit commenter “TheGoldenDon” claimed on the pro-Trump Reddit page “The_Donald” that “Hillary Clinton recorded a $700k loss to avoid paying taxes in 2015.” The post included an image from the Clintons’ return which shows that the Clintons had a net long-term capital loss of $699,540 carried over from a prior tax year. The image was picked up by the conservative blog Zero Hedge, which stated that the returns show that Hillary Clinton “Used Same Tax Avoidance ‘Scheme’ As Trump.”

The claim rocketed through the conservative media and has been repeatedly cited on this morning’s Fox & Friends, where co-host Ainsley Earhardt claimed that the “$700,000 loss” shows that “Hillary did the same thing” as Trump.

In fact, as the next page of the tax returns show, while the Clintons claimed a $700,000 capital loss carried over from a prior year, they could take a deduction for only of $3,000 for that loss:

The first page of the tax return confirms that the Clintons received a $3,000 deduction for their capital loss:

The next page confirms that they paid $3,236,975 in federal income tax that year.

The Clintons claimed a $726,721 capital loss on their 2008 tax returns -- likely as a result of the financial crash -- and have carried forward the loss and claimed a $3,000 deduction in each subsequent year. The campaign says they have paid an effective federal tax rate of between 25 percent and 38.2 percent every year since 2001.

This data is available because the Clintons have released decades of tax returns, while Trump has shunned more than 50 years of precedent by refusing to release any tax information.