Media figures are inaccurately equating Democratic presidential nominee Hillary Clinton’s use of a common tax deduction on her 2015 tax return to Republican presidential nominee Donald Trump’s $916 million declared loss in 1995, which, The New York Times reported, he could have used to virtually wipe out his federal income tax obligations over the past two decades. Several media outlets have falsely claimed Clinton “did the same thing” as Trump when, in fact, Clinton’s 2015 tax return shows that she could take only a $3,000 deduction for her reported $700,000 loss, and her campaign reports that she has paid between a 25 and 38 percent income tax rate since 2001.

Media Falsely Equate Trump’s Billion-Dollar Tax Avoidance Scheme With Clinton’s Taxes

Written by Alex Kaplan

Published

Trump Potentially Avoided “Paying Any Federal Income Taxes For Up To 18 Years”

NY Times: After Nearly $1 Billion Loss In 1995, Trump May Have Used Tax Rules To Avoid Paying Hundreds Of Millions In Taxes. After declaring “a $916 million loss on his 1995 income tax returns,” Republican presidential nominee Donald Trump may have “legally avoid[ed] paying any federal income taxes for up to 18 years,” according to The New York Times, which obtained a copy of some of Trump's tax documents. Utilizing “tax rules especially advantageous to wealthy filers,” wrote the Times, Trump could have used the massive “financial wreckage he left behind in the early 1990s” to “cancel out an equivalent amount of taxable income over an 18-year period.” From the October 1 article:

Donald J. Trump declared a $916 million loss on his 1995 income tax returns, a tax deduction so substantial it could have allowed him to legally avoid paying any federal income taxes for up to 18 years, records obtained by The New York Times show.

The 1995 tax records, never before disclosed, reveal the extraordinary tax benefits that Mr. Trump, the Republican presidential nominee, derived from the financial wreckage he left behind in the early 1990s through mismanagement of three Atlantic City casinos, his ill-fated foray into the airline business and his ill-timed purchase of the Plaza Hotel in Manhattan.

Tax experts hired by The Times to analyze Mr. Trump’s 1995 records said that tax rules especially advantageous to wealthy filers would have allowed Mr. Trump to use his $916 million loss to cancel out an equivalent amount of taxable income over an 18-year period.

Although Mr. Trump’s taxable income in subsequent years is as yet unknown, a $916 million loss in 1995 would have been large enough to wipe out more than $50 million a year in taxable income over 18 years.

The $916 million loss certainly could have eliminated any federal income taxes Mr. Trump otherwise would have owed on the $50,000 to $100,000 he was paid for each episode of “The Apprentice,” or the roughly $45 million he was paid between 1995 and 2009 when he was chairman or chief executive of the publicly traded company he created to assume ownership of his troubled Atlantic City casinos. Ordinary investors in the new company, meanwhile, saw the value of their shares plunge to 17 cents from $35.50, while scores of contractors went unpaid for work on Mr. Trump’s casinos and casino bondholders received pennies on the dollar. [The New York Times, 10/1/16]

Reddit Post Claims Clinton Used Same Tax Avoidance Scheme

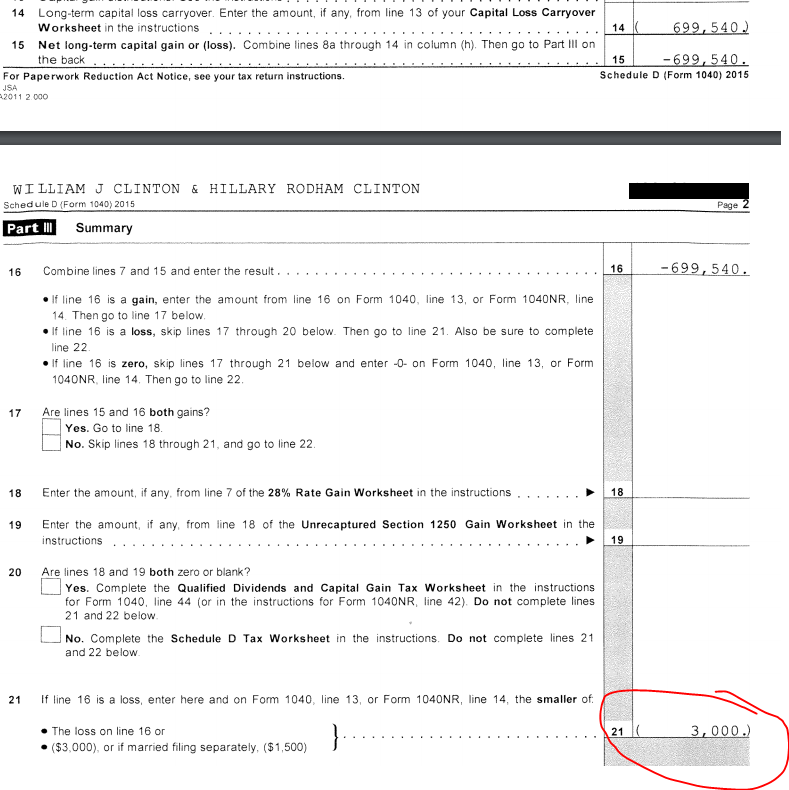

Reddit Commentator Claims Clinton Used Loss To Avoid Paying Taxes. Reddit commenter “TheGoldenDon” claimed on the pro-Trump Reddit page “The_Donald” that Democratic presidential nominee “Hillary Clinton recorded a $700k loss to avoid paying taxes in 2015.” The post included an image from the Clintons’ return, which shows that the Clintons had a net long-term capital loss of $699,540 carried over from a prior tax year.

[Reddit, 10/2/16]

Zero Hedge: Clinton “Used Same Tax Avoidance ‘Scheme’ As Trump.” The fringe financial blog Zero Hedge picked up the claim from Reddit, writing that “we now discover none other than Hillary Rodham Clinton utilized a $700,000 ‘loss’ to avoid paying some taxes in 2015.” From the October 3 blog post:

Well this is a little awkward. With the leaked 1995 Trump tax returns 'scandal' focused on the billionaire's yuuge “net operating loss” and how it might have 'legally' enabled him to pay no taxes for years, we now discover none other than Hillary Rodham Clinton utilized a $700,000 “loss” to avoid paying some taxes in 2015.

[...]

While not on the scale of Trump's business “operating loss”, Hillary Clinton - like many 'wealthy' individuals is taking advantage of a legal scheme to use historical losses to avoid paying current taxes. [Zero Hedge, 10/3/16]

But Clinton Used Only $3,000 Allowance On 2015 Return

Tax Return For 2015 Shows Clinton Could Take Only $3,000 Deduction For Her Loss. A copy of Bill and Hillary Clinton’s 2015 tax return shows that while they did have a nearly $700,000 capital loss carried over from a prior year, they could take a deduction for only $3,000 for that loss. The first page of the tax return also confirms that the Clintons received a $3,000 deduction for their capital loss, and the returns show they paid $3,236,975 in federal income taxes that year. From the tax return:

[HillaryClinton.com, 2015 Tax Return, accessed 10/3/16]

Clintons Claimed Loss During Height Of Financial Crisis In 2008. According to tax returns made public by the campaign, the Clintons claimed a $726,721 capital loss on their 2008 tax records in the midst of the financial crisis and Great Recession. They have carried forward the loss and claimed a $3,000 deduction in each subsequent year. [HillaryClinton.com, 2008 Tax Return, accessed 10/3/16]

Clintons Have Paid Between 25 Percent And 38 Percent Income Tax Rate Every Year Since 2001. According to the same publicly available tax documents, the Clintons have paid an effective federal tax rate of between 25 percent and 38.2 percent every year since 2001:

[HillaryClinton.com, accessed 10/3/16]

Media Repeat False Claim Claim That Clinton Exploited Same Tax Rule As Trump

CNN’s Chris Cuomo: Trump Supporters Claim “Clinton Did The Same Thing.” CNN co-host Chris Cuomo uncritically said that “Trump supporters” were saying that “Clinton did the same thing” and that the Clintons, “on their 2015 tax return, they have a carry-forward loss of some $700,000.” From the October 3 edition of CNN’s New Day:

CHRIS CUOMO (CO-HOST): Well, it’s important to note that only [Trump’s] staunchest supporters are calling this “genius.” Nobody is. And it hasn't been handled well politically because, as Errol [Louis] said, he should have gotten out in front of it. They’re saying two things now in response. One, Clinton did the same thing. [The Clintons], on their 2015 tax return, they have a carry-forward loss of some $700,000. It's legal. People do it. I’ve never heard of one this size on a personal income tax return. That's right. And so -- but to do it where it lasts for two decades is unusual. The second thing they're saying is it's illegal, and it shows that the media is biased because The New York Times is committing a crime by publishing this. [CNN, New Day, 10/3/16]

CNN’s Jeffrey Lord: Clinton “Did Exactly The Same Thing Donald Trump Did.” Citing the Zero Hedge blog, CNN contributor and Trump supporter Jeffrey Lord claimed that Clinton “did exactly the same thing Donald Trump did” and “had a loss, a claimed loss, of almost $700,000 and she used it as an excuse to get down her tax bill and not pay current taxes in 2015.” From the October 3 edition of CNN’s CNN Newsroom with Carol Costello:

CAROL COSTELLO (HOST): This billion -- almost billion-dollar loss by Donald Trump, some people saying he hasn't paid income taxes in 18 years. How does that say he's a great, successful businessman?

JEFFREY LORD: Carol, you know the thing that I find fascinating about this, we're learning this morning from a site called Zero Hedge that has lasered in on Hillary Clinton's much-talked-about tax returns that she always says how open she's ever been, and on page 17 of those tax returns for 2015 we find out that Hillary Clinton did exactly the same thing Donald Trump did. She had a loss, a claimed loss, of almost $700,000 and she used it as an excuse to get down her tax bill and not pay current taxes in 2015, meaning she used exactly the same device, albeit for less money, that Donald Trump did. [CNN, CNN Newsroom with Carol Costello, 10/3/16]

Fox’s Heather Childers: Clinton “Used The Same Thing On A $700,000 Loss.” Fox co-host Heather Childers, discussing the New York Times report during the October 3 edition of Fox & Friends First, claimed, “And Hillary Clinton herself also used the same thing on a $700,000 loss that she reported in her own tax returns that she released. [Fox News, Fox & Friends First, 10/3/16]

Fox’s Ainsley Earhardt: Clinton “Didn’t Pay Any Taxes In 2014.” During a segment in which co-host Steve Doocy and Fox Business host Stuart Varney defended Trump for not “do[ing] anything wrong” with his reported tax scheme, Fox co-host Ainsley Earhardt claimed the attention on the Times report was “ironic” because “Hillary Clinton has” done the same thing. Earhardt said Clinton “took a $700,000 loss” and “didn't pay any taxes in 2014.” From the October 3 edition of Fox News’ Fox & Friends:

STEVE DOOCY (CO-HOST): Stuart, he didn’t do anything wrong

STUART VARNEY: No, he did not do anything wrong at all. Nothing illegal. Nothing unethical. I've done it myself actually, as have a lot of other taxpayers. You lose capital, in my case it was on a real estate deal, you can carry forward that loss to get it offset -- offset it against future income. I've done it myself. Millions of Americans have done it. He did it on a very large scale.

AINSLEY EARHARDT (CO-HOST): Here's the ironic thing, though. Hillary Clinton has done it. She's calling it a “scheme.” Yet in 2015, she took a $700,000 loss and The New York Times, they're saying he, Donald Trump, avoided paying taxes. Well guess what? So did they. They didn't pay any taxes in 2014 and they got a tax refund of $3.5 million.

DOOCY: They left that out of the story.

EARHARDT: Right. [Fox News, Fox & Friends, 10/3/16]

Drudge: “Hillary Used Same Avoidance 'Scheme'...”

![]()

[The Drudge Report, 10/3/16]

Heat Street: “Clinton May Have Used Same ‘Loss Avoidance’” As Trump. The conservative blog Heat Street cited Zero Hedge to claim Clinton “could use the same ‘loss avoidance’ technique to skip writing her own check for 2016.” From the October 3 blog:

The Times report, an early “October surprise”, left the Trump camp searching for the right line of response. But late Sunday evening, the closely-read financial blog Zero Hedge reported that Hillary Clinton, who reported a $700,000 loss on her publicly available 2015 tax returns, could use the same “loss avoidance” technique to skip writing her own check for 2016.

[...]

This analysis might be welcome news for Trump, whose anger over the Times’s revelations made headlines alongside his tax returns. [Heat Street, 10/3/16]

Gateway Pundit: “Hypocrite Hillary Clinton Used SAME TAX AVOIDANCE LAW As Trump To Save Money On Taxes.” The Gateway Pundit’s Jim Hoft claimed Clinton was a “shameless hypocrite” because she criticized Trump for “us[ing] the same tax ‘scheme’ on her taxes last year.” From the October 2 blog:

WOW! Shameless hypocrite Hillary Clinton attacked Donald Trump today for using the current law to avoid paying taxes for several consecutive years.

Hillary posted several tweets attacking Trump for using a common legal tax offset scheme.

[...]

Now this…

Hillary Clinton used the same tax “scheme” on her taxes last year.

WOW![...]

While not on the scale of Trump’s business “operating loss”, Hillary Clinton – like many ‘wealthy’ individuals is taking advantage of a legal scheme to use historical losses to avoid paying current taxes. [The Gateway Pundit, 10/2/16]