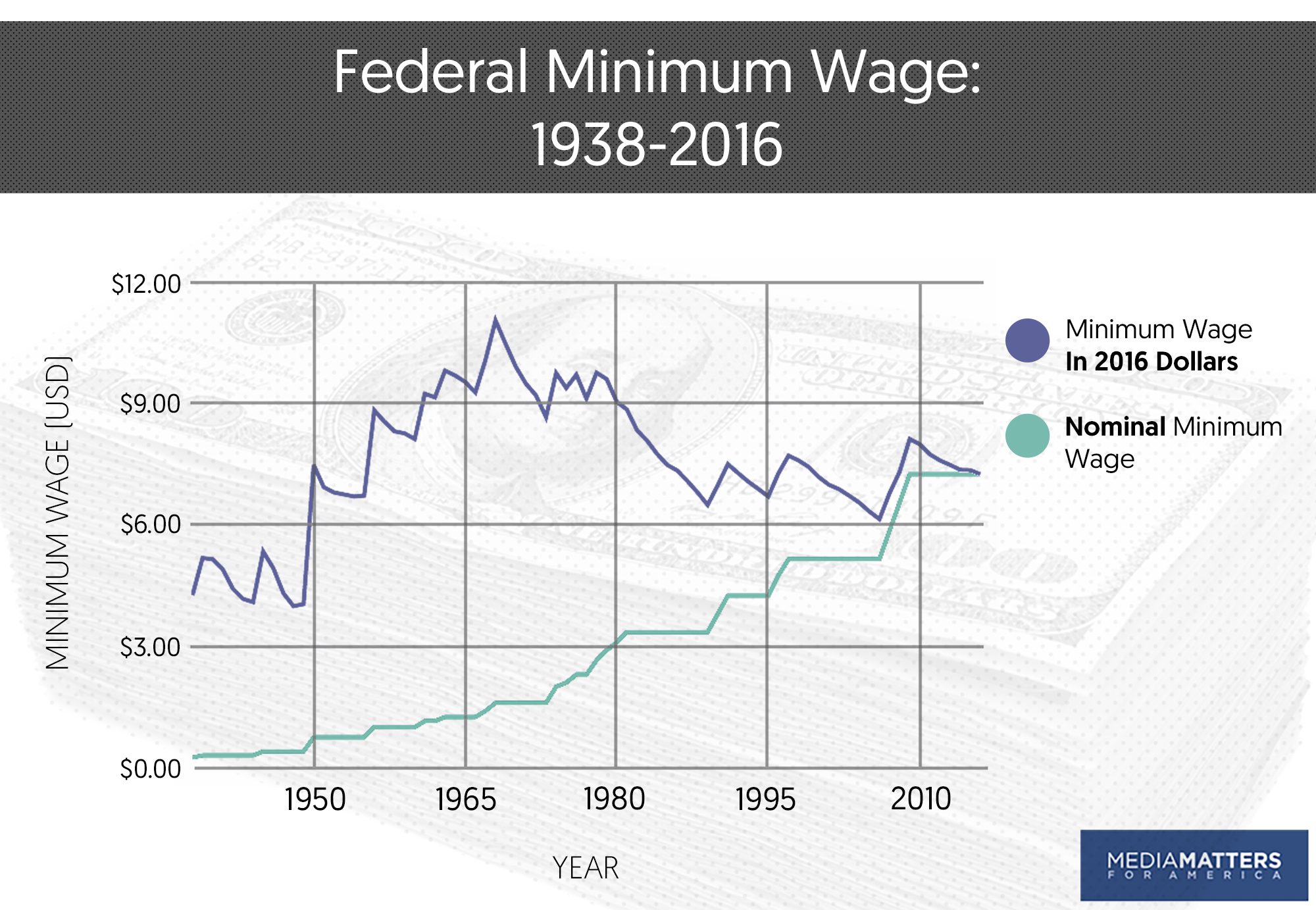

On June 25, 1938, President Franklin Roosevelt signed the Fair Labor Standards Act (FLSA) into law and established the first nationwide minimum hourly wage. The relative value of the minimum wage has fluctuated considerably over time, but it has steadily eroded since reaching an inflation-adjusted peak in 1968 -- the $1.60 per hour wage that year would be worth roughly $11.05 today. For several years, in the face of a growing movement to lift local, state, and federal minimum wages to a livable standard, right-wing media opponents have frequently promoted a number of misleading and discredited myths about the minimum wage’s economic effects.

Myths & Facts: The Minimum Wage

Written by Alex Morash

Published

Workers See Raises In Some Places, While Others Have Not Seen A Real Raise In 30 Years

The Minimum Wage Peaked In 1968 And Has Eroded For Nearly Five Decades. After adjusting for inflation, the current federal minimum wage ($7.25 per hour in 2016) is roughly equal to what it was worth in 1986. Thirty years of relative stagnation highlight a five-decade-long erosion of the minimum wage threshold, which peaked in terms of its inflation-adjusted value in 1968. Since it was last increased in July 2009, the federal minimum wage has lost more than 10 percent of its relative purchasing power:

[Department of Labor, accessed 6/21/16; Bureau of Labor Statistics, CPI Inflation Calculator, accessed 6/21/16]

The Federal Minimum Wage Was Last Increased On July 24, 2009. After annual increases from 2007 to 2009, the federal baseline minimum wage has remained stagnant at $7.25 per hour since July 24, 2009. [Department of Labor, 7/16/09]

The Fight For $15 Has Won Raises For 17 Million Americans. According to the National Employment Law Project (NELP), the Fight for $15 movement and the minimum wage advocates it has inspired have already won minimum wage increases for nearly 17 million workers since 2012. Ten million of these workers will see minimum wages reach $15 per hour. The movement has had victories in 51 cities and states, representing a “wave of action” that is “historic in scale”:

The U.S. economy has tilted so far towards low-paying jobs that today 42 percent of America’s workers earn less than $15 per hour. In November 2012, when fast-food workers first went on strike launching the Fight for $15, they helped make the issue of income inequality and falling paychecks one of the nation’s top economic issues. Since then, unprecedented numbers of states, cities, and individual employers have taken action to raise wages.

- Since 2012, states, cities, the Obama Administration, and scores of private employers have raised pay for 17 million workers.

- Nearly 10 million of these workers—59 percent—will receive gradual raises to $15 as a result of the Fight for $15.

- 8.8 million through state $15 wage increases—chiefly the historic increases approved by California and New York last month.

- 863,000 through city $15 wage increases—such as those that Seattle, San Francisco, Los Angeles, and other cities approved over the past three years.

- And 88,000 through voluntary action by private employers such as Facebook, Aetna, and Nationwide Insurance that have raised pay scales to $15 or more for their employees or employees of their contractors.

[National Employment Law Project, April 2016]

Myth 1: Minimum Wage Increases Will Hurt Business

Myth 2: Minimum Wage Increases Are Opposed By Small Businesses

Myth 3: Minimum Wage Increases Will Result In Job Losses

Myth 4: Minimum Wage Workers Are Teenagers Who Will Soon Move Onto Other Jobs

Myth 5 Minimum Wage Increases Will Result In Higher Unemployment For Teenagers

Myth 6: Minimum Wage Work Is Not Worth $15 Per Hour

Myth 7: Minimum Wage Workers Are Not Really Low-Income

Myth 8: Minimum Wage Increases Will Expand Welfare Dependence

Myth 9: Minimum Wage Increases Lead To More Automation

Myth 10: Minimum Wage Increases Lead To Price Inflation

Myth: Minimum Wage Increases Will Hurt Business

Fox News Falsely Claimed Call For Minimum Wage Increases Is To Blame For Drop In Profits At McDonald’s. Fox Business host Maria Bartiromo appeared on the October 22, 2014, edition of Fox & Friends to discuss a 30 percent drop in quarterly profits at McDonald's. Bartiromo misleadingly attributed this drop to widespread calls for a minimum wage increase, even though the company itself pointed to image problems, not the minimum wage, as the major factor in the loss. Bartiromo and the hosts agreed that calls for a minimum wage increase caused profits to drop and forced McDonald's to turn to workforce automation. [Fox News, Fox & Friends, 10/22/14, via Media Matters]

Fox’s Neil Cavuto Blames Higher Wages For Poor Walmart Earnings Report. Fox News host Neil Cavuto blamed higher wages for employees at Walmart for the company witnessing a 10 percent decline in its stock value in a single day. Cavuto badgered his guest Richard Fowler, a supporter of living wages, about Walmart’s drop in stock value, stating, “I hope you’re satisfied.” Cavuto claimed that “Walmart’s business cannot sustain these increases” in pay. [Fox News, Your World with Neil Cavuto, 10/14/14]

Fact: Raising The Minimum Wage Is Good For Businesses

Demos: Higher Minimum Wage Is Good For Business. The nonpartisan policy research center Demos points to Costco CEO Craig Jelinek as an example of a business executive who supports raising the minimum wage because he believes it would be good for business. Jelinek finds that higher wages encourage hard work, a strong work ethic and employee loyalty. Increased wages also put more money into the hands of consumers, which has a multiplier effect on economic growth:

Craig Jelinek, president and CEO of the retail giant Costco, has emerged as the most prominent advocate of the Harkin-Miller bill. Jelinek’s company is known for its relatively generous pay scale, with employees starting out at $11.50 per hour or higher.

The higher pay is worth it to the company because employees are motivated to work harder and stick with the company, Jelinek says. Now he is arguing that all businesses would see a similar benefit from a national minimum wage increase. “Instead of minimizing wages, we know it’s a lot more profitable in the long term to minimize employee turnover and maximize employee productivity, commitment and loyalty,” he says. [Demos, 3/11/13]

NELP: Companies With 100 Or More Employees Employ 66 Percent Of All Low-Wage Workers. The National Employment Law Project (NELP) published a report in July 2012 on the makeup of low-wage employers, which found that 66 percent of low-wage workers are employed by large, profitable corporations. NELP also found that the 50 largest low-wage employers paid an average of $9.4 million annually to their chief executives and spent tens of billions of dollars annually on shareholders, despite paying poverty wages to many employees:

The central finding of this report is that the majority of America's lowest-paid workers are employed by large corporations, not small businesses, and that most of the largest low-wage employers have recovered from the recession and are in a strong financial position.

Specifically:

- The majority (66 percent) of low-wage workers are not employed by small businesses, but rather by large corporations with over 100 employees;

- The 50 largest employers of low-wage workers have largely recovered from the recession and most are in strong financial positions: 92 percent were profitable last year; 78 percent have been profitable for the last three years; 75 percent have higher revenues now than before the recession; 73 percent have higher cash holdings; and 63 percent have higher operating margins (a measure of profitability) - all after adjusting for inflation;

- Top executive compensation averaged $9.4 million last year at these firms, and they have returned $174.8 billion to shareholders in dividends or share buybacks over the past five years.

[National Employment Law Project, July 2012]

Myth: Minimum Wage Increases Are Opposed By Small Businesses

Fox Business Turns To Restaurant Executives To Attack Fight For $15 Demonstrations. Fox Business host Stuart Varney focused on nationwide protests to raise the minimum wage, and his guests were almost exclusively minimum wage opponents. He continued Fox’s heavy reliance on restaurant executives -- White Castle vice president Jamie Richardson and Bennigan’s CEO Paul Mangiamele -- who peddle misinformation about the supposed negative consequences of paying employees minimum wages of up to $15 per hour. [Fox Business, Varney & Co., via Media Matters, 4/14/16]

Fox’s Neil Cavuto Hosts White Castle VP And Former Toys “R” Us CEO To Attack Minimum Wage Increase. White Castle’s Richardson and Jerry Storch, former CEO of Toys “R” Us, joined Neil Cavuto in January 2014 to expressed their opposition to minimum wage increases. Storch claimed a minimum wage increase is “bad for the country, it's bad for growth, [and] it's bad for jobs.” Richardson claimed raising the federal mandated minimum wage “doesn't create ladders of opportunity.” Cavuto subsequently said that “if the economy is so bad that it warrants extending unemployment benefits for the umpteenth time, then surely it warrants going slow on increasing the minimum wage.” [Fox News, Your World with Neil Cavuto, via Media Matters, 1/29/14]

Fact: Actual Small Businesses Overwhelmingly Support Raising The Minimum Wage

Republican Pollster Frank Luntz: 80 Percent Of Business Executives Polled Support Raising The Minimum Wage. The Washington Post reported on a leaked poll conducted for the Council of State Chambers of Commerce by Republican pollster Frank Luntz, which found that “80 percent of respondents said they supported raising their state's minimum wage, while only eight percent opposed it.” The Post reported that Luntz said the polling data shows that it's “undeniable that they [business executives] support the increase.” Luntz told state chamber executives that if they're “fighting a minimum wage increase,” they could suggest other “poverty-reduction methods like the Earned Income Tax Credit” in order to “defuse” the support. From the April 4 edition of The Washington Post (emphasis added):

Whenever minimum wage increases are proposed on the state or federal level, business groups tend to fight them tooth and nail. But actual opposition may not be as united as the groups' rhetoric might make it appear, according to internal research conducted by a leading consultant for state chambers of commerce.

The survey of 1,000 business executives across the country was conducted by LuntzGlobal, the firm run by Republican pollster Frank Luntz, and obtained by a liberal watchdog group called the Center for Media and Democracy. ... Among the most interesting findings: 80 percent of respondents said they supported raising their state's minimum wage, while only eight percent opposed it.

“That's where it's undeniable that they support the increase,” Luntz told state chamber executives in a webinar describing the results, noting that it squares with other polling they've done. “And this is universal. If you're fighting against a minimum wage increase, you're fighting an uphill battle, because most Americans, even most Republicans, are okay with raising the minimum wage.” [The Washington Post, via Media Matters, 4/4/16]

Small Business Majority: 60 Percent Of Small Businesses Support Raising The Minimum Wage Nationwide. The Small Business Majority, a national small-business advocacy organization, on July 29 released the results of a poll of small-business owners gauging support for raising the federal minimum wage. They found 60 percent of small-business owners supported raising the minimum wage to at least $12 per hour, and half of respondents already paid workers at least $12 per hour. Additionally, the poll found that one-fifth of small-business owners already pay workers a minimum of $15 per hour or more. [Small Business Majority, 7/29/15]

Business For A Fair Minimum Wage: 56 Percent Of Small-Business Owners Believe Raising The Minimum Wage Would Help The Economy. In July 2014, Business for a Fair Minimum Wage surveyed business owners with two to 99 employees and found that over 60 percent supported increasing the federal minimum wage and 56 percent believed raising the minimum wage would help the economy:

[Business for a Fair Minimum Wage, July 2014]

[Business for a Fair Minimum Wage, July 2014]

Myth: Minimum Wage Increases Will Result In Job Losses

Fox's Charles Payne: Raising The Minimum Wage Would “Actually Destroy Job Creation.” Fox News guest host Charles Payne claimed that “it's been proven that these higher minimum wages actually destroy job creation.” [Fox News, Your World With Neil Cavuto, 3/30/16]

Forbes Contributor Cherry-Picks From Reports To Claim Raising The Minimum Wage Will Increase Unemployment. Forbes contributor Tim Worstall cherry-picked parts of a report to the Los Angeles City Council from University of California, Berkeley, economist Michael Reich on the effects of raising the minimum wage to $15 per hour in Los Angeles to claim it showed raising wages does more harm than good, “making us all poorer in the aggregate.” Worstall failed to mention that the report also found that raising the minimum wage to $15 per hour would lead to higher wages for over 40 percent of workers in Los Angeles. [Forbes, 3/28/16]

Fox's Neil Cavuto Hosted Home Depot CEO Who Called Minimum Wage Increases A Job Killer. Neil Cavuto invited Bernie Marcus, Home Depot's co-founder and former CEO, to promote the idea that while the minimum wage “looks great, it looks phenomenal, and it actually sells in America,” it would “cost jobs where we don't want it to,” such as among “the minorities” and “the young people.” [Fox News, Your World with Neil Cavuto, 11/11/15]

Fox’s Neil Cavuto Hosts Former McDonald's USA President Who Claims Raising Minimum Wage Would Be A “Job-Costing Event.” On the November 10 edition of Your World, Cavuto hosted Ed Rensi, a former McDonald's USA CEO, who claimed a minimum wage increase would destroy jobs. Cavuto asked Rensi if individuals protesting for a higher minimum wage “could be pushing themselves right out of a job.” Rensi responded that “there's no question about it ... This is going to be a job-costing event.” [Fox News, Your World with Neil Cavuto, 11/10/15]

Fact: Economists Have Repeatedly Debunked Claims That Better Wages Kill Jobs

Strong Employment Growth Undermines Right-Wing Media Claims Higher Minimum Wages Threatens Job Creation. On February 15, The Seattle Times reported that Washington was “far outpacing” other states in job and wage growth for the fourth quarter of 2015, according to the most recent ADP Workforce Vitality Report. The state's outstanding performance after Seattle and SeaTac started raising minimum wages in their cities to $15 per hour runs counter to the doom-and-gloom scenarios pushed by right-wing media about the supposed side effects of elevated minimum wages:

Washington is really overperforming on employment growth," said Ahu Yildirmaz, head of research for ADP, a payroll services company.

Nationwide, employment and wages both increased by 2.1 percent year-over-year during the fourth quarter of 2015.

In Washington, however, employment climbed by 3.7 percent. Much of that came from hiring in construction, information technology, professional services, and leisure and hospitality industries.

[...]

In sectors such as in retail and hospitality, some employers in the region are raising wages for managers in response to recent minimum-wage bumps in Seattle and SeaTac, said Sage Wilson, spokesperson for Working Washington, an advocacy organization.

Anecdotally, Wilson has heard of employers outside of those cities finding that they must match higher wages to compete for employees. The minimum-wage increases, however, are relatively new and could take years before they significantly impact statewide data. [The Seattle Times, via Media Matters, 2/15/16]

Cornell University Study Debunks Myth That Minimum Wage Increases Hurt Job Market For Low-Wage Workers. Researchers at Cornell University found that over the past 20 years, raising the regular and tipped minimum wage for workers in the restaurant and hospitality industries has “not had large or reliable effects” on the number of people working in those industries. The researchers also found that increased wages could have positive side effects such as reduced employee turnover, and they recommended that opponents embrace “reasonable increases in the minimum wage.” From the December 2015 edition of the Cornell Hospitality Report:

Although minimum wage increases almost certainly necessitate changes in restaurant prices or operations, those changes do not appear to dramatically affect overall demand or industry size. Furthermore, there is strong evidence that increases in the minimum wage reduce turnover, and good reason to believe that it may increase employee productivity as well. While prospective large increases in minimum wage mandates may have more noticeable effects, the evidence suggests that the restaurant industry should accept reasonable, modest increases in the minimum wage.

[...]

There is strong evidence that increases in the minimum wage reduce turnover, as mentioned previously. While no study has tested our belief that increasing the minimum wage will increase employee happiness and productivity as well, our reasoning is theoretically sound and consistent with more general research on compensation effects. Moreover, the research reviewed and reported here suggests that the industry has little to lose by acting on this belief. Thus, we contend that the restaurant industry should support rather than oppose reasonable increases in the minimum wage. [Cornell Hospitality Report, December 2015]

Michael Reich: Raising Minimum Wage To $15 Lifts Pay For At Least 40 Percent Of Workers, Resulting In A Net Increase In Jobs. In a March 2015 report, economist Michael Reich and a team of researchers from the University of California, Berkeley found that over 40 percent of workers in Los Angeles would receive a direct or indirect pay increase if the city's minimum wage were set at $15 per hour.Forbes cited the report as proof that increasing the minimum wage to $15 would destroy thousands of low-wage jobs, but its actual finding was that the overall “employment changes” would be “quite small when compared to projected job growth of 2.5 percent a year in the city,” and it estimated that the cumulative effect would be an increase of “5,262 jobs by 2019 at the county level”:

- The proposed policy would result in significant benefits to workers and their families. By 2017, we estimate that 542,000 workers in Los Angeles, or 37.8 percent of the covered workforce, will receive a wage increase from the proposed law. These estimates include a ripple effect in which some workers who earn above the new minimum wage also receive an increase. Average annual earnings will increase by 20.4 percent, or $3,200 (in 2014 dollars).

- By 2019, we estimate that 609,000, or 41.3 percent of the covered workforce, will receive a wage increase from the proposed law. Average annual earnings will increase by 30.2 percent, or $4,800 (in 2014 dollars).

- The large majority of affected workers will be adults with a median age of 33 (only 3 percent are teens).

[...]

- The costs of the proposed minimum wage law will be concentrated in Los Angeles City, but the full benefits will be realized throughout Los Angeles County, because more than half of the affected workers live, and therefore spend most of their increased earnings, outside the city.

- Los Angeles City: Combining costs and benefits and taking into account multiplier effects, we estimate a cumulative net reduction in GDP of $135 million by 2017 and $315 million by 2019, or 0.1 percent compared to a scenario with no city minimum wage increase. These effects on the level of economic activity correspond to a cumulative net reduction in employment in Los Angeles City of 1,552 jobs by 2017 and 3,472 jobs by 2019, or 0.1 and 0.2 percent of all employment, respectively. These employment changes are quite small when compared to projected job growth of 2.5 percent a year in the city.

- Los Angeles County: Combining costs and benefits and taking into account multiplier effects, we estimate a cumulative net increase in employment of 3,666 jobs by 2017 and 5,262 jobs by 2019 at the county level.

[University of California, Berkeley, Institute For Research On Labor And Employment, March 2015]

CEPR: Increasing The Minimum Wage Has “No Discernable Effect” On Employment. In an exhaustive report that reviewed dozens of individual studies and meta-analyses of the minimum wage to gauge the relationship between increased minimum wages and employment, the Center for Economic and Policy Research (CEPR) concluded in February 2013 that local, state, and federal minimum wage increases had a negligible effect on job creation. One of the meta-studies in CEPR's review was a 2009 peer-reviewed paper by economists Hristos Doucouliagos and T.D. Stanley, which plotted the estimated jobs impact of 1,492 separate calculations contained in 64 distinct studies. The paper found that the overwhelming majority of the “most precise estimates” of positive and negative jobs impacts were “clustered at or near zero”:

[...]

Economists have conducted hundreds of studies of the employment impact of the minimum wage. Summarizing those studies is a daunting task, but two recent meta-studies analyzing the research conducted since the early 1990s concludes that the minimum wage has little or no discernible effect on the employment prospects of low-wage workers. [Center for Economic and Policy Research, February 2013]

IRLE: Increased Minimum Wages Had Zero Effect On Employment. The University of California, Berkeley's Institute for Research on Labor and Employment (IRLE) in April 2012 looked at the link between raising minimum wages and job creation. The IRLE found no change in job growth tied to raising minimum wages:

Summarizing to this point, we find that our border-discontinuity estimates find strong positive responses of earnings to a minimum wage increase. This rise in earnings is met with a change in the employment stock that is indistinguishable from zero. [University of California, Berkeley, Institute for Research on Labor and Employment, April 2012]

CEPR: Hiring Response To Minimum Wage Hikes “More Likely To Be Positive Than Negative.” CEPR concluded that minimum wage increases are “more likely” to result in job creation than job loss in a March 2011 report. According to CEPR's analysis, employment effects tended to “cluster near zero,” with no major employment losses or gains tied to wage increases:

Our estimated employment responses generally cluster near zero, and are more likely to be positive than negative. Few of our point estimates are precise enough to rule out either positive or negative employment effects, but statistically significant positive employment responses outnumber statistically significant negative elasticities. [Center for Economic and Policy Research, March 2011]

Myth: Minimum Wage Workers Are Teenagers Who Will Soon Move Onto Other Jobs

Washington Free Beacon: “Majority Of Minimum Wage Earners” Are Teenagers. The Washington Free Beacon argued against an increase in the minimum wage on February 14, 2013, claiming it would hurt teenagers and that teenagers made up the bulk of minimum wage workers. The outlet used the 2011 Bureau of Labor Statistic (BLS) report on the characteristics of the minimum wage to continue pushing the claim that minimum wage earners are predominantly young people, failing to note that BLS’s data show only 23.5 percent of minimum wage earners were teenagers in 2011. [The Washington Free Beacon, 2/14/13]

Fox’s Stuart Varney: “We're Not Expecting People To Live On That. That's Not What The Minimum Wage Is For, For Heaven's Sake.” Scott Page, CEO of the Lifeline Program that provides telecommunications assistance to low-income families, asked Varney how a single parent could live off $9 per hour during the February 13, 2013, edition of Varney & Co. Varney responded that “you don’t” expect parents to live on the minimum wage and that “it’s for people fresh out of high school.” [Fox Business, Varney & Company, 2/13/13]

Fact: A Majority Of Minimum Wage Workers Are Over 25 And Have Few Avenues For Career Advancement

BLS: 55 Percent Of Minimum Wage Earners In 2015 Were 25 Years Or Over In Age. According to the Bureau of Labor Statistics (BLS), in 2015, of the more than 2.5 million American workers paid at or below the federal minimum wage, more than half were aged 25 and above, representing 1.4 million people. Teenagers ages 16 to 19 represented 28 percent of minimum wage workers in 2002 and have since declined to 19 percent of all minimum wage workers by 2015. [Bureau of Labor Statistics, BLS Reports, Table 7, April 2016]

IRLE: In Los Angeles, Raising The Minimum Wage To $15 Lifts Pay For Over 40 Percent Of Workers, And “Only 3 Percent Are Teens.” Economist Michael Reich studied the effects of raising minimum wages to $15 an hour in Los Angeles, with a team of researchers from IRLE and found that over 40 percent of workers in Los Angeles would receive a direct or indirect pay increase if the city's minimum wage were set at $15 per hour. The report found the large majority affected would be adults, with the median age being 33:

- The proposed policy would result in significant benefits to workers and their families. By 2017, we estimate that 542,000 workers in Los Angeles, or 37.8 percent of the covered workforce, will receive a wage increase from the proposed law. These estimates include a ripple effect in which some workers who earn above the new minimum wage also receive an increase. Average annual earnings will increase by 20.4 percent, or $3,200 (in 2014 dollars).

- By 2019, we estimate that 609,000, or 41.3 percent of the covered workforce, will receive a wage increase from the proposed law. Average annual earnings will increase by 30.2 percent, or $4,800 (in 2014 dollars).

- The large majority of affected workers will be adults with a median age of 33 (only 3 percent are teens).

[Institute For Research On Labor And Employment, University of California, Berkeley, March 2015]

NELP: Entry-Level Workers Are “Going Nowhere Fast.” In a July 2013 review of low-wage positions in the fast food industry titled “Going Nowhere Fast,” the National Employment Law Project (NELP) found that entry-level positions offered little room for promotion or advancement. The study also concluded that the fast food industry purposely engages in misinformation, promoting a ”mobility myth" to low-wage employees:

Despite what the data make clear about the barriers to upward mobility in the fast food industry, spokespersons for the industry and representatives from the major chains have collectively promoted a “mobility myth” that characterizes low-wage fast food jobs as springboards for advancement to managerial positions or opportunities to open a franchise [National Employment Law Project, July 2013]

EPI: Low-Wage Workers Are Not Predominantly Teenagers. The Economic Policy Institute (EPI) published a report on the demographics of low-wage workers on April 27, 2012, which found most are not teenagers. EPI found that women, young people, and people of color are overrepresented in low-wage jobs and that less than a third of low-wage workers live in households making more than $50,000 a year:

- Female, young, and minority workers are overrepresented in the ranks of low-wage workers, when “low-wage” is defined as below the wage that a full-time, full-year worker would have to earn to live above the federally defined poverty threshold for a family of four. (In 2011, this was $23,005 per year, or $11.06 when adjusted to hourly wages.)

- In 2011, only 31.5 percent of low-wage workers lived in households with a family income greater than $50,000, indicating that low-wage workers are not predominately teenagers living with their parents or adults with low-paying jobs living with a higher-earning spouse

[Economic Policy Institute, 4/27/12]

CEPR: Minimum Wage Workers “Older And Better Educated Than Ever.” The Center for Economic and Policy Research (CEPR) revealed in an April 2012 report that from 1979 to 2011 the share of low-wage workers with some college education increased from 19.5 to 33.3 percent. An additional 9.9 percent of low-wage workers had also completed a college degree, up from just 5.7 percent in 1979. [Center for Economic and Policy Research, April 2012]

Myth: Minimum Wage Increases Will Result In Higher Unemployment For Teenagers

Fox Regular Art Laffer: “The Minimum Wage Makes No Sense”; It’s Just The “Black Teenage Unemployment Act.” Right-wing economist and Fox regular Art Laufer, the so-called father of trickle-down economics, proclaimed that he was “in favor of, at least for teenagers, getting rid of the minimum wage” on the January 8, 2014, edition Fox News’ Happening Now. Laufer proclaimed that the existence of a minimum wage was responsible for unemployment in minority communities, and he labeled it the “black teenage unemployment act.” [Fox News, Happening Now, 1/8/14]

Forbes: Minimum Wage Is Too High, Cause Of Youth Unemployment. Forbes’ Tim Worstall argued that high rates of youth unemployment can be explained by focusing on increasing minimum wage rates. Worstall looked at youth unemployment in European countries since the Great Recession and concluded that higher minimum wages will hurt young people because “the untried and untrained will have the lowest productivity” and therefore not be worth employing at higher wages. [Forbes, 12/23/11]

Fact: Raising The Minimum Wage Has No Major Effect On Teen Employment

IRLE: Minimum Wage Has Nothing "But Very Small” Effects On Teen Employment. The Institute for Research on Labor and Employment (IRLE) concluded in an April 2011 report that the effects of minimum wage increases had “all but very small negative long-run effects” on teen employment:

Including controls for long-term growth differences among states and for heterogeneous economic shocks renders the employment and hours elasticities indistinguishable from zero and rules out any but very small disemployment effects. Dynamic evidence further shows the nature of bias in traditional estimates, and it also rules out all but very small negative long-run effects. [Institute for Research on Labor and Employment, University of California, Berkeley, April 2011]

EPI: “The Warnings Of Massive Teen Job Loss Due To Minimum Wage Increases Simply Do Not Comport With The Evidence.” Economist Heidi Shierholz argued in a November 25, 2009, essay for the Economic Policy Institute (EPI) that teen employment is affected more by broad economic trends, like a recession, than by changes in the minimum wage:

While it is true that there is some disagreement among economists about whether increasing the minimum wage increases or decreases employment, there is a consensus on the essential point: the impact of a minimum wage raise on jobs, whether positive or negative, is small. The warnings of massive teen job loss due to minimum wage increases simply do not comport with the evidence. [Economic Policy Institute, 11/25/09]

Myth: Minimum Wage Work Is Not Worth $15 Per Hour

Fox’s Andrew Napolitano Claims “Poor People” Are “Not Worth” A $15 Per Hour Wage. Fox News senior judicial analyst Andrew Napolitano suggested that politicians are trying to “force employers to pay some of their employees more than their services are worth” in an April 6 op-ed in the right-wing Washington Times. Later that morning, Napolitano appeared on Fox Business’ Varney & Co. and claimed that “poor people will lose their jobs because they simply are not worth” $15 per hour. [Fox News, Fox & Friends, via Media Matters, 4/7/16]

Fact: The Minimum Wage Is Too Low

CEPR: If The Minimum Wage Reflected Increases In Worker Productivity, It Would Be Nearly $22 Per Hour. The Center for Economic and Policy Research (CEPR) explained in a March 2012 issue brief that if the federal minimum wage had kept up with increasing worker productivity since the 1970s, it would have reached $21.72 per hour in 2012:

By all of the most commonly used benchmarks -- inflation, average wages, and productivity -- the minimum wage is now far below its historical level.

[...]

Since 1968, however, productivity growth has far outpaced the minimum wage. If the minimum wage had continued to move with average productivity after 1968, it would have reached $21.72 per hour in 2012 -- a rate well above the average production worker wage. If minimum-wage workers received only half of the productivity gains over the period, the federal minimum would be $15.34. Even if the minimum wage only grew at one-fourth the rate of productivity, in 2012 it would be set at $12.25. [Center for Economic and Policy Research, March 2012]

CEPR: U.S. Minimum Wage “Too Low” To Reduce Low-Wage Work. CEPR also found that the United States led all wealthy member states of the Organisation for Economic Cooperation and Development (OECD) in low-wage work in a January 2012 report. CEPR concluded that the U.S. minimum wage was “too low to reduce the share of low-wage work” in the economy and was a contributing factor to lingering economic inequality. [Center for Economic and Policy Research, January 2012]

Myth: Minimum Wage Workers Are Not Really Low-Income

WSJ’s Jason Riley: Most Minimum-Wage Workers Are Not Poor; They’re Teenagers Or Retirees. Wall Street Journal editorial board member Jason Riley wrote in an April 5 op-ed that raising the minimum wage to $15 per hour would not reduce poverty, because so few workers at those wage levels actually live in low-income households. He concluded that a wage increase would cost young people and entry-level workers jobs, hurting workers of color in particular, without benefitting workers struggling with poverty. [The Wall Street Journal, 4/5/16]

WSJ’s Jason Riley: Minimum Wage Workers Aren't Poor Or Breadwinners. On Fox Business' Freedom Watch, Riley argued that minimum wage workers did not really need a wage increase because most are not in poverty nor “breadwinners” despite the wage being “sold by proponents as an anti-poverty measure.”[Fox Business, Freedom Watch, 5/11/11, via Nexis]

Fact: Working At Minimum Wage Is Not Enough To Pay Rent And Living Expenses

States Where It’s Possible To Afford Rent On Minimum Wage: Zero. Good magazine released a video demonstrating how many hours of minimum wage work are needed to pay rent “affordably” on April 20, and did not find a single state where someone could afford rent on 40 hours of work on the federal minimum wage of $7.25. The research found that the federal minimum wage is so low and “flat out, inhumane” that the least amount of work hours needed was 49 in South Dakota. Maryland and New York residents would need to work over 90 hours per week, and residents in Hawaii came in at over 120 hours of the work a week just to make rent. (There are only 168 hours in a week):

[Good, 4/20/16]

ThinkProgress: Living Wage In California And New York Would Be $22 Per Hour. ThinkProgress published a national map on living wages on October 16 created by the social justice advocacy organization The Alliance For A Just Society. It shows that even $15 per hour would not be a living wage in most states; in California and New York, the living wage would be $22 per hour. The piece noted that the “federal minimum wage still remains at an impossibly low $7.25 per hour”:

[ThinkProgress, 10/16/15]

[ThinkProgress, 10/16/15]

Myth: Minimum Wage Increases Will Expand Welfare Dependence

“Entitlement Nation Run Amok”: Fox’s Andrew Napolitano Claims Raising The Minimum Wage Will Force People Onto Welfare. Napolitano claimed on Fox News’ Fox & Friends that raising the minimum wage would result in price increases that put necessities beyond the reach of low-wage workers while destroying jobs for low-income workers and expanding reliance on public assistance programs. [Fox News, Fox & Friends, via Media Matters, 4/7/16]

WSJ Promotes Myth That Higher Wages Push Workers Onto Government “Dole.” New York lawyer John H. Heyer argued in an op-ed published by The Wall Street Journal that the minimum wage is a “scam” that actually increases poverty. He claimed that increasing wages will force businesses to lay off employees and, in turn, swell the ranks of federal social safety-net programs, which Heyer referred to as the government “dole.” [The Wall Street Journal, 5/5/14]

Fact: Low Wages Force Workers Onto Assistance Programs, Costing Taxpayers Billions

EPI: Raising The Federal Minimum Wage To $12 Per Hour Would Reduce Federal Spending By $17 Billion. According to research from EPI and Oxfam America, 43.7 percent of American workers make less than $15 per hour and 40 percent of those low-wage workers live at or near the poverty line.. The report reinforced previous EPI findings that raising the minimum wage helps low-wage workers earn more income and reduces government spending on public assistance programs, finding that “raising the federal minimum wage to $12 could reduce federal spending by $17 billion”:

A boost in the federal minimum wage is not just helpful for workers—it’s also good for taxpayers. When workers earn poverty wages, they are compelled to turn to assistance programs, private and public. EPI previously found that raising the federal minimum wage to $12 could reduce federal spending by $17 billion.

To keep a family of four out of poverty, a full-time worker needs to earn nearly $12 an hour (40 hours a week, 52 weeks a year—no breaks). Many low-wage workers live either at or near the federal poverty line. For example, roughly half (47.1 percent) of workers making under $12 an hour report a family income that places them below or near the federal poverty level.18 For workers earning under $15 an hour, two in five workers (40.0 percent) are either living in or near poverty.

Many low-wage workers and their families depend on federal and state public assistance programs to make ends meet. For instance, among workers earning under $15 an hour, over 10 million depend on SNAP (food stamps) to put food on the table. [Oxfam America / Economic Policy Institute, June 2016]

Labor Center: Low Wages In Fast Food Industry Alone Cost Taxpayers Nearly $7 Billion Annually. Fast-food workers alone cost taxpayers roughly $7 billion annually in increased public assistance spending, according to an October 2013 report by the University of California, Berkeley's Center for Labor Research and Education. The bulk of public assistance is caused by low wages, which force workers to rely on Medicaid, the Children's Health Insurance Program (CHIP), “food stamp” benefits from the Supplemental Nutrition Assistance Program (SNAP), and the Earned Income Tax Credit (EITC):

- More than half (52 percent) of the families of front-line fast-food workers are enrolled in one or more public programs, compared to 25 percent of the workforce as a whole.

- The cost of public assistance to families of workers in the fast-food industry is nearly $7 billion per year.

- At an average of $3.9 billion per year, spending on Medicaid and the Children’s Health Insurance Program (CHIP) accounts for more than half of these costs.

- Due to low earnings, fast-food workers’ families also receive an annual average of $1.04 billion in food stamp benefits and $1.91 billion in Earned Income Tax Credit payments.

- People working in fast-food jobs are more likely to live in or near poverty. One in five families with a member holding a fast-food job has an income below the poverty line, and 43 percent have an income two times the federal poverty level or less.

- Even full-time hours are not enough to compensate for low wages. The families of more than half of the fast-food workers employed 40 or more hours per week are enrolled in public assistance programs.

[University of California, Berkeley, Center for Labor Research and Education, 10/15/13]

Federal Reserve Bank Of Chicago: “A $1 Minimum Wage Hike Increases Total Spending By Approximately $700 Per Quarter In The Near-Term.” Economists with the Federal Reserve Bank of Chicago released a report on February 8, 2011, on the spending and debt responses to raising the minimum wage, which found that raising wages for minimum wage workers increases their individual and household consumer spending power. The Chicago Fed also found that individuals earning the minimum wage spend an additional $250 per quarter for every $1 hourly raise while household spending increases by $700:

First, a $1 minimum wage hike increases total spending by approximately $700 per quarter in the near-term. This exceeds the roughly $250 per quarter increase in family income following a minimum wage hike of similar size. These patterns are corroborated by independent data showing that debt rises substantially after a minimum wage increase. Second, the majority of this additional spending goes toward durable goods, in particular vehicles. Consequently, the spending response is concentrated among a small number of households. Third, total spending increases within one quarter of a minimum wage increase and not prior, despite legislation typically passing 6 to 18 months before enactment. Finally, high levels of durables spending and debt accumulation persist for several quarters after a minimum wage hike. [Federal Reserve Bank of Chicago, 2/8/11]

Myth: Minimum Wage Increases Lead To More Automation

Fox’s Stuart Varney: “Attention, $15-An-Hour Minimum Wage Protesters ... That Robot Is Going To Take Your Job.” Fox’s Varney claimed, while rolling footage of a new humanoid robot from Boston Dynamics, that "$15-an-hour minimum wage protesters" should be worried that “that robot is going to take your job” while guest Elizabeth MacDonald referenced a February 2016 report from the White House Council of Economic Advisers, which concluded that millions of jobs could be automated over the coming decades, ignoring that the same report noted that automation would also lead to new jobs and entire new sectors. [Fox Business, Varney & Co., 2/24/16]

Wash. Post: $15-Per-Hour Minimum Wage May Lead To “Robot-Powered Restaurants” Of The Future. The Washington Post suggested that a ballot initiative to raise the minimum wage in Washington, D.C., combined with similar efforts in cities around the country, could threaten millions of food service workers whose positions might be replaced by “burger-flipping robots” if activists succeed in increasing the federal minimum wage to $15 per hour.. [The Washington Post, via Media Matters, 8/17/15]

Fact: Automation Could Affect All Kinds Of Jobs At Every Income Level

Experts Speculate That Technological Advancement And Process Automation Could Put Any Job At Risk. Authors Erik Brynjolfsson and Andrew McAfee speculate in their e-book “Race Against the Machine” that increased computing power and technical complexity could drive economic growth while negatively affecting millions of job seekers. From Race Against The Machine:

It may seem paradoxical that faster progress can hurt wages and jobs for millions of people, but we argue that's what's been happening. As we'll show, computers are now doing many things that used to be the domain of people only. The pace and scale of this encroachment into human skills is relatively recent and has profound economic implications. Perhaps the most important of these is that while digital progress grows the overall economic pie, it can do so while leaving some people, or even a lot of them, worse off. [Race Against The Machine, online excerpt, accessed 6/24/16]

Economist Michael Jones: Robots Will Replace Some Jobs, Creating New Jobs In The Process. University of Cincinnati assistant professor of economics Michael Jones argued in a Washington Post op-ed that while workforce automation will threaten some jobs, it will also generate new productivity and create new industries. Jones compared fears of automation in the present to the textile workers opposed to automation of the 1800s who decried new technological advancements in their factories. Jones pointed to multiple studies that show critics of automation are “crying wolf” because automation does displace workers in some sectors but complements workers in other sectors and also creates new sectors:

Machines are indeed replacing humans – and replicating what we thought were uniquely human skills – at a faster rate than many of us thought possible until recently.

For example, at the beginning of the 21st century, few people would have imagined that a computer could beat the best human in the world at Jeopardy. And yet, in 2011, IBM’s supercomputer Watson bested two former Jeopardy superstars, Ken Jennings and Brad Rutter.

But a focus on technology’s substitutionary (or replacement) role fails to appreciate how it also can be complementary. Job loss in some occupations will certainly continue, but it will be accompanied by gains in different fields, just as in the past. [The Washington Post, 2/17/16]

AP: "Recession, Tech Kill Middle-Class Jobs.” In the first of a three-part series on middle-class job losses in the wake of the Great Recession, economic and business reporters Bernard Condon and Paul Wiseman discussed at length the role automation has played in hollowing out the American middle-class job market:

Most of the jobs will never return, and millions more are likely to vanish as well, say experts who study the labor market. What's more, these jobs aren't just being lost to China and other developing countries, and they aren't just factory work. Increasingly, jobs are disappearing in the service sector, home to two-thirds of all workers.

They're being obliterated by technology.

Year after year, the software that runs computers and an array of other machines and devices becomes more sophisticated and powerful and capable of doing more efficiently tasks that humans have always done. [Associated Press, 1/23/13]

Myth: Minimum Wage Increases Lead To Price Inflation

Fox’s Neil Cavuto Lectured Minimum Wage Advocate That The Price Of Big Macs Would Go Up. Fox’s Cavuto berated minimum wage advocate Naquasia Legrand during the April 4 edition of Your World with Neil Cavuto that the cost of a Big Mac could increase from roughly $4 to nearly $5.50 if her movement succeeded in lifting wages for fast-food workers.[Fox News, Your World with Neil Cavuto, 4/4/16]

Fact: Raising The Minimum Wage Would Have A Negligible Effect On Prices

Researchers Conclude That $15-Per-Hour Wages In Fast-Food Industry Would Raise Prices By 4.3 Percent. Researchers at Purdue University concluded that increasing the minimum wage of fast-food workers to $15 per hour nationwide would result in only a 4.3 percent increase in restaurant prices in a July 2015 report. According to The Economist’s Big Mac Index, a 4.3 percent increase in the cost of a Big Mac in the United States would be roughly 21 cents. The report also found that raising wages to $22 per hour would result in a 25 percent increase:

Raising wages to $15 an hour for limited-service restaurant employees would lead to an estimated 4.3 percent increase in prices at those restaurants, according to a recent study.

Researchers from Purdue University's School of Hospitality and Tourism Management also examined the impact of limited-service restaurants offering health-care benefits and found that, due to current tax credits in the Affordable Care Act, there would be a minimal effect on prices at limited-service restaurants with fewer than 25 full-time employees.

Limited-service restaurants are what many consumers refer to as “fast-food restaurants,” where there usually is no tableside service and no tipping.

The study says increasing wages to $22 an hour, which the Bureau of Labor Statistics says is what the average American private industry employee makes, would cause a 25 percent increase in prices.

The current federal minimum wage is $7.25 an hour, which also is the standard in Indiana. Some states and cities across the United States, including Illinois, Michigan and Ohio, have raised the minimum wage to more than $8 an hour. In the past two years, fast-food workers across the nation have gone on strike or had demonstrations calling for (living) wages to be increased to $15 per hour, the study says. [Purdue University, 7/27/15; The Economist, accessed 6/24/16]