In the four years since the minimum wage was last raised, right-wing media have forwarded a number of myths to prevent any possible increase in the future, which often directly contradict economic evidence.

Right-Wing Media's History Of Attacking The Minimum Wage

Written by Craig Harrington

Published

July 24, 2013, Marks The Fourth Anniversary Of The Last Federal Minimum Wage Increase

The Federal Minimum Wage Was Last Increased On July 24, 2009, To $7.25 Per Hour. After being raised annually from 2007 to 2009 the federal baseline remained stagnant since July 24, 2009, as the economy struggled to recover from recession. [Department of Labor, 7/16/09]

President Obama Has Proposed A $9 Minimum Wage. President Obama called upon Congress to increase the federal minimum wage to $9 per hour during his State of the Union Address on February 13, 2013. [Whitehouse.gov, 2/13/2013]

Right-Wing Media Have A Documented History Of Forwarding Myths On Minimum Wage

Is the minimum wage already high enough?

Is the minimum wage only for teenagers?

Does the minimum wage lead to job losses?

Is the minimum wage driving service automation?

Is the minimum wage bad policy?

MYTH: The Minimum Wage Is High Enough Already, Too High

Nicole Petallides: The Minimum Wage “Really Has Grown Exponentially” In Recent Years. On the February 14 edition of Fox News' Fox & Friends, Fox Business correspondent Nicole Petallides said:

As you continue to raise the minimum wage, which was $5.15 back in 2007, so it really has grown exponentially, we've had on on the Fox Business Network, small business owners, franchise owners, who talk about the fact that (a) they just won't be hiring as much, (b) that if they have to go from $7.25 up to nine bucks, then the nine-dollar employees are going to say hey, how come this inexperienced young worker is making what I'm making and I want a raise, too. [Fox News, Fox & Friends, 2/14/13]

Elizabeth MacDonald: The Minimum Wage Jumped 41 Percent In Three Years From 2007 To 2009. In her FoxBusiness.com column, network correspondent Elizabeth MacDonald wrote:

For the 10-year period from 1997 to 2007, the minimum wage was $5.15 per hour. Congress raised it to $5.85 in 2007, then again to $6.55 in 2008 and finally to $7.25 in 2009. That means over that three-year span, businesses who rely on minimum-wage workers saw their labor costs jump 41%, right as the economic crackup began. [FoxBusiness.com, 2/13/13]

FACT: Real Value Of The Minimum Wage Is Dropping, Increasing Inequality

The Real Value Of The Minimum Wage Decreases Every Year, Is Lower Today Than Historical Average. Economic growth and natural price inflation have already overcome the minimum wage increase from four years ago. After adjusting for inflation, Department of Labor data reveal the real value of the minimum wage has declined 8 percent from 2009 to 2013. This represents $0.64 of lost real wages in four years. The minimum wage first rose above the current inflation-adjusted value on January 25, 1950. By the same measure, the minimum wage first rose above the Obama proposal of $9 per hour on September 3, 1963. [Department of Labor, accessed 7/18/13]

The Historical Average Minimum Wage Is Closer To $8 Per Hour. Adjusting for inflation, the minimum wage has averaged roughly $8 per hour over the past six decades. President Obama's call for a $9 minimum wage would still fall short of historical highs. [Department of Labor, accessed 7/18/13]

Paul Krugman: “Current Level Of The Minimum Wage Is Very Low By Any Reasonable Standard.” In a New York Times op-ed Nobel Prize-winning economist Paul Krugman argued that raising the minimum wage was both good politics and sound policy. Moreover, he argued in favor of increasing the federal baseline to keep up with inflation:

For about four decades, increases in the minimum wage have consistently fallen behind inflation, so that in real terms the minimum wage is substantially lower than it was in the 1960s. Meanwhile, worker productivity has doubled. [The New York Times, 2/17/13]

If The Minimum Wage Reflected Increases In Worker Productivity, It Would Be Nearly $22 Per Hour. Citing a study done by the Center for Economic and Policy Research, The Huffington Post explained that the current minimum wage lags far behind what it should be after accounting for productivity increases. From The Huffington Post:

The minimum wage should have reached $21.72 an hour in 2012 if it kept up with increases in worker productivity, according to a March study by the Center for Economic and Policy Research. While advancements in technology have increased the amount of goods and services that can be produced in a set amount of time, wages have remained relatively flat, the study points out. [The Huffington Post, 2/13/13]

EPI: Declining Value Of Minimum Wage Drives Inequality. In a February 2013 report, the Economic Policy Institute found that the declining value of the federal minimum wage relative to inflation is a major contributing factor to growing levels of economic inequality:

Contrary to some political rhetoric of late, wage stagnation for American workers and rising inequality is not due to lack of effort... Rather it is due to certain policies that have weakened the bargaining position of low- and middle-wage workers. Among these policies is the refusal to set the minimum wage at a level where it establishes a well-enforced wage floor at 50 percent of the average wage. [Economic Policy Institute, 2/21/13]

MYTH: Minimum Wage Jobs Are Only For Teenagers, Housewives

Stuart Varney: “We're Not Expecting People To Live On That. That's Not What The Minimum Wage Is For. ” From the February 13 edition of Fox Business' Varney & Company:

SCOTT PAGE (CEO, THE LIFELINE PROGRAM): No one making $9 an hour, that's $18,000 a year, how do you expect people to live right now on $14,000 a year with one child...?

STUART VARNEY (HOST): You don't expect people to live -- We're not expecting people to live on that. That's not what the minimum wage is for, for heaven's sake. It's for people fresh out of high school getting their very very first job, it's not for guys in their forties and fifties. It's not for them. [Fox Business, Varney & Company, 2/13/13]

The Washington Free Beacon: “Majority Of Minimum Wage Earners” Are Teenagers. From an article in The Washington Free Beacon arguing against an increase in the minimum wage:

However, those 19 states boast some of the highest unemployment rates in the nation, especially among the teenagers who make up the majority of minimum wage earners. [The Washington Free Beacon, 2/14/13]

Jason Riley: Minimum Wage Workers Aren't Poor, Breadwinners. On the May 11, 2011, edition of Fox Business' Freedom Watch, Jason Riley of The Wall Street Journal's editorial board argued that minimum wage workers did not really need wage increase because most are not in poverty:

The minimum wage is sold by proponents as an anti-poverty measure. The reality is that most people who are in poverty already make more than minimum wage. And most people who make minimum wage aren't poor. They are teenagers, retirees, housewives working a job on the side. But they're not the main breadwinner of the family. So what the minimum wage does, in essence, is price low-skilled, experienced people out of the labor force. [Fox Business, Freedom Watch, 5/11/11, via Nexis]

Forbes: Minimum Wage Is Too High, Cause Of Youth Unemployment. Forbes contributor Tim Worstall argued that high rates of youth unemployment can be explained by focusing on increasing minimum wage rates:

If there are effects upon employment chances as a result of the minimum wage being too high then those effects are going to be felt by the untrained and untried in the labour force: the young. [Forbes, 12/23/11]

FACT: Millions Of Workers Depend On Minimum Wage Jobs For Full-Time Work

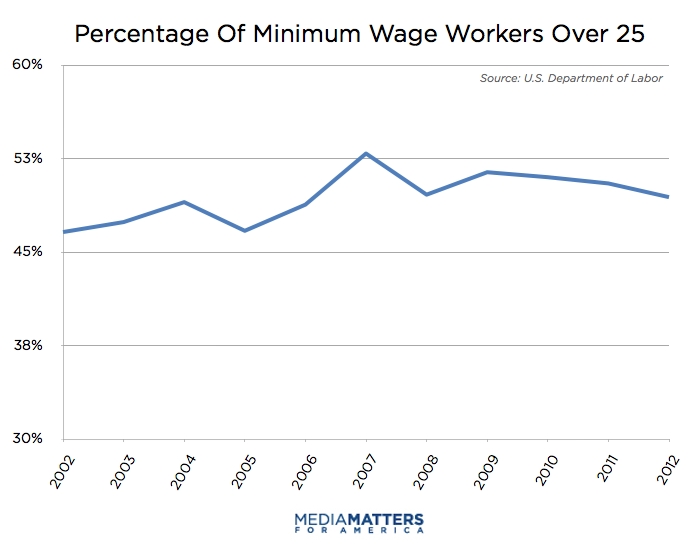

Half Of Minimum Wage Workers Are Over 25. Contrary to the conservative talking point that minimum wage jobs are ideally suited for teenagers and entry-level workers, Department of Labor data show roughly half of all minimum wage workers are over 25 years old. [Bureau of Labor Statistics, accessed 7/18/13]

CEPR: Minimum Wage Workers “Older And Better Educated Than Ever”. In an April 2012 report, the Center for Economic and Policy Research revealed that from 1979 to 2011 the share of low-wage workers with some college education increased from 19.5 to 33.3 percent. An additional 9.9 percent of low-wage workers had also completed a college degree, up from just 5.7 percent in 1979. [Center for Economic and Policy Research, April 2012]

CEPR: U.S. Minimum Wage “Too Low” To Reduce Low Wage Work. In a January 2012 report, the Center for Economic and Policy Research found that the United States led all wealthy member states of the Organisation for Economic Cooperation and Development (OECD) in low wage work. CEPR went on to conclude that the U.S. minimum wage was “too low to reduce the share of low wage work”. [Center for Economic and Policy Research, January 2012]

FACT: Minimum Wage Increases Do Not Hurt Teen Employment

EPI: “The Warnings Of Massive Teen Job Loss Due To Minimum Wage Increases Simply Do Not Comport With The Evidence.” In a November 25, 2009, post, the Economic Policy Institute found that teen employment is affected more by broad economic trends, like a recession, rather than changes in the minimum wage:

While it is true that there is some disagreement among economists about whether increasing the minimum wage increases or decreases employment, there is a consensus on the essential point: the impact of a minimum wage raise on jobs, whether positive or negative, is small. The warnings of massive teen job loss due to minimum wage increases simply do not comport with the evidence. [Economic Policy Institute, 11/25/09]

University Of California Berkeley: Minimum Wage Has Nothing “But Very Small Disemployment Effects” On Teen Employment. A June 2010 report by University of California-Berkeley's Institute for Research on Labor and Employment (IRLE) studying the effects of minimum wage increases on teen employment found:

Including controls for long-term growth differences among states and for heterogeneous economic shocks renders the employment and hours elasticities indistinguishable from zero and rules out any but very small disemployment effects. Dynamic evidence further shows the nature of bias in traditional estimates, and it also rules out all but very small negative long-run effects. [Institute for Research on Labor and Employment, UC Berkeley, 6/21/10]

MYTH: The Minimum Wage Kills Jobs

The Washington Times: “Mandated Minimum Wage Hikes Often Lead To Massive Job Loss.” From The Washington Times:

President Obama's push to hike the minimum wage from $7.25 per hour to $9 per hour may sound good to minimum wage earners, but business owners and economic analysts aren't applauding. History shows that mandated minimum wage hikes often lead to massive job loss. [The Washington Times, 2/13/13]

Karl Rove: “Raising The Minimum Wage To $9 An Hour Would Actually Cost Jobs.” In his Wall Street Journal column the day after President Obama announced his minimum wage proposal in the State of the Union address, Rove wrote:

Nevertheless, the president's suggestions won't spur job creation and economic growth. His proposals were liberal, stale, unfocused and often counterproductive. For example, raising the minimum wage to $9 an hour would actually cost jobs. [The Wall Street Journal, 2/13/13]

FACT: Increasing The Minimum Wage Has No Effect On Unemployment, May Increase Hiring

Jared Bernstein: Political Process Won't Allow Wage Increase That Would Be Harmful. Economist Jared Bernstein, a senior fellow at the Center on Budget and Policy Priorities, argues that federally mandated wage increases dating back to the 1950s have typically not been large enough to carry negative employment effects. [On the Economy, 2/17/13]

CEPR: The Minimum Wage Has “No Discernible Effect” On Employment Prospects. In a February 2013 report, the Center for Economic and Policy Research concluded that the minimum wage has no negative effect on job-seekers or employment levels:

Economists have conducted hundreds of studies of the employment impact of the minimum wage. Summarzing those studies is a daunting task, but two recent meta-studies analyzing the research conducted since the early 1990s concludes that the minimum wage has little or no discernible effect on the employment prospects of low-wage workers. [Center for Economic and Policy Research, February 2013]

CAP: Increasing Minimum Wage During High Unemployment Does Not Kill Jobs. An analysis conducted by the Center for American Progress found that increasing the minimum wage during periods of high unemployment had no negative employment effects:

Policymakers should feel confident that raising the minimum wage would not have harmful employment effects and instead would likely provide the kind of boost in consumer demand that our economy sorely needs. [Center for American Progress Action Fund, 6/20/12]

CEPR: Hiring Response To Minimum Wage Hikes “More Likely To Be Positive Than Negative.” In a March 2011 report, the Center for Economic and Policy Research concluded that wage increases are more likely to result in more, rather than fewer, jobs:

Overall, we find little evidence that the three citywide minimum wages had any systematic effect on employment in low-wage establishments, including the fast-food industry, the broader food-services sector, and retail trade. Our estimated minimum-wage policy elasticities generally cluster near zero, and are slightly more likely to be positive than negative.[Center for Economic and Policy Research, March 2011]

Multiple Studies Found Either No Effect On Employment Or An Increase In Employment Resulting From Minimum Wage Increases. From the Center for American Progress:

University of California, Berkeley, economist David Card and Princeton economist Alan Krueger's seminal study of the effect of the New Jersey 1992 minimum wage increase comparing fast food industry employment in New Jersey and Pennsylvania found no negative employment effect. In fact, it found stronger employment growth in New Jersey. While there was no national recession at the time, New Jersey's unemployment rate was 8.7 percent in parts of 1992.

Similarly, Lawrence F. Katz, a Harvard economist, and Alan Krueger studied fast food employment in Texas from 1990 to 1991 and found that employment slightly increased when the minimum wage was raised. The study included a 1990 minimum wage increase that occurred just before the 1990-1991 recession and a second increase that occurred just after the recession officially ended.

Moreover, David Card's study of the impacts on teen employment of the 1990 federal minimum wage increase using state-level data found no effect on teen employment. Most of the time period he studied included the 1990-1991 recession. [Center for American Progress Action Fund, 6/7/11]

MYTH: High Minimum Wage To Blame for Service Automation

John Stossel: Increasing The Minimum Wage Destroys Job Opportunity. Appearing in a Fox News special aired December 17, 2010, Fox Business' John Stossel blamed the minimum wage for the increasing prevalence of automation in entry-level service work that leads to unemployment:

Warren Meyer manages public parks. When the minimum wage went up he replaced workers with machines.

[...]

With the higher minimum wage, he switched to automated ticket machines. Fewer people; more unemployment. [Fox News,Politicians' Top 10 Promises Gone Wrong, 12/17/10]

Wall Street Journal: Fearing Minimum Wage Increase, Business Replacing Employees With iPads. In an article describing the potential effects of President Obama's minimum wage proposal, The Wall Street Journal reported that Just Cupcakes LLC of Virginia Beach is considering replacing its minimum wage cashiers with self-service tablets rather than paying a $9 hourly rate:

In order for her Just Cupcakes LLC to remain profitable in the face of higher expected labor costs, Ms. Hesseltine believes the customer-ordering process “would have to be more automated” at the Virginia Beach, Va., chain, which has two strip-mall locations as well as a food van. Thus, she could eliminate the 10 workers who currently ask customers what they would like to eat. [The Wall Street Journal, 3/27/13]

Forbes: Higher Salary Would Force Employers To Replace Workers With Machines. In an article on the hypothetical effects of raising the minimum wage to $20 an hour, Jack Anderson argued that, faced with higher wages, businesses will seek greater efficiency and more automation:

Because in order to pay the higher wages, you had to increase prices. And when you increased prices, all of your customers started going to a nearby restaurant that elected to get more efficient instead of raising prices. [Forbes, 2/20/13]

FACT: Automation Affects Every Job Sector, Not Just Minimum Wage Work

Experts Speculate Technological Advancement And Process Automation Could Put Any Job At Risk. Authors Erik Brynjolfsson and Andrew McAfee speculate in their e-book “Race Against the Machine” that increased computing power and technical complexity could drive economic growth while negatively affecting millions of job seekers.

It may seem paradoxical that faster progress can hurt wages and jobs for millions of people, but we argue that's what's been happening. As we'll show, computers are now doing many things that used to be the domain of people only. The pace and scale of this encroachment into human skills is relatively recent and has profound economic implications. Perhaps the most important of these is that while digital progress grows the overall economic pie, it can do so while leaving some people, or even a lot of them, worse off. [Online excerpt, accessed 7/23/13]

Associated Press: "Recession, Tech Kill Middle-Class Jobs'. In the first of a three-part series on middle-class job losses in the wake of the Great Recession, economic and business reporters Bernard Condon and Paul Wiseman discussed at length the role automation has played in hollowing out the American job market.

Year after year, the software that runs computers and an array of other machines and devices becomes more sophisticated and powerful and capable of doing more efficiently tasks that humans have always done. [Associated Press, 1/23/13]

MYTH: Increasing Minimum Wage Is Bad Policy

National Review Online: Minimum Wage Has “Long-Term Negative Consequences”. Veronique de Rugy, a senior research fellow at the Mercatus Center, argued in an NRO blog that increasing the minimum wage carries “long-term negative consequences” including pricing workers out of the market and encouraging youths to drop out of school in pursuit of minimum wage work [National Review Online, 3/8/13]

National Review Online: Raising Minimum Wage Destroyed Samoan Economy. NRO columnist James Sherk fought back against the idea of doubling the minimum wage by comparing the United States economy to that of American Samoa:

Super-sizing Samoa's minimum wage did not boost consumer spending, stimulate the economy, or create jobs. It did not even boost pay. Instead, after just three of ten scheduled increases, Samoan unemployment septupled from 5 percent to 36 percent. One of the islands' two tuna canneries cut benefits and hours while laying off workers and freezing hiring. The other closed entirely. Real wages fell 11 percent as inflation outstripped pay growth. [National Review Online, 6/28/13]

FACT: Economists, Researchers Support Increasing The Minimum Wage

Jared Bernstein: Countries Without Minimum Wages Still Have Unemployment. During an April 3 Intelligence Squared debate, conservative pundits Russ Roberts and Jim Dorn argued that the United States should abolish its minimum wage and embrace the free market to solve the unemployment crisis. Economist Jared Bernstein chided this criticism, stating:

It's the ultimate low-road strategy. Let's dump our labor standards and emulate developing economies where such institutions as minimum wages have not yet evolved. [The Huffington Post, 4/4/13]

Robert Reich: “Raising The Minimum Wage From $7.25 To $9 Should Be A No-Brainer”. Economist Robert Reich argues that increasing the minimum wage will not lead to higher levels of automation or widespread job losses because most jobs at that level are in retail, food service, hospitality and other “personal service” sectors. Reich claims these jobs cannot be outsourced or automated and any increased costs are passed on to the consumer. [RobertReich.org, 2/15/13]

Chicago Fed: Increasing Minimum Wage Boosts The Economy In The Short Run. Economists Daniel Aaronson and Eric French of the Federal Reserve Bank of Chicago found that increasing the federal minimum wage from $7.25 to $9 would result in a $48 billion boost in household spending over the following year. Recognizing that this figure represents just 0.3 percent of GDP, they concluded:

We are skeptical that minimum wage hikes boost GDP in the long run. Nevertheless, we do find evidence that putting money into the hands of consumers, especially low-wage consumers, leads to predictable increases in spending in the short run. [Chicago Fed Letter, August 2013]

Demos: Higher Minimum Wage Is Good For Business. The non-partisan policy research center Demos argued that increasing the current federal minimum wage is good for business, claiming that higher wages encourage hard work, strong work ethic and employee loyalty. Increased wages also put more money into the hands of consumers, which has a multiplier effect on economic growth. [Demos,3/11/13]

Bloomberg Businessweek: “Higher Minimum Wage? Small Business Doesn't Mind.” In an article on small business' reaction to increasing the minimum wage, Bloomberg Businessweek noted that business interests had long been opposed to increasing the federal minimum wage, but “public anger over income inequality deepening and economic research challenging the notion that higher wages suppress employment” has caused many small businesses to support an increase. [Bloomberg Businessweek, 2/21/13]

Video by John Kerr, charts by Albert Kleine