The Wall Street Journal called for reform that would lighten the tax burden on corporations without noting that corporate tax revenue has reached historic lows in a time of historically high profits.

Following the May 21 Senate hearing into Apple's strategies to lighten its corporate tax burden, a Wall Street Journal editorial argued that the real issue was not the company's ability to dodge taxes, but the fact that U.S. corporate taxes are “the developed world's highest.” The editorial concluded that the U.S. should lower its corporate tax rate to “ideally zero, but 12.5% also works.”

The editorial's main argument that U.S. corporate taxes are too high hinges upon pointing to statutory corporate tax rates. In defending Apple's practices, it explains:

The genuine outrage is that Apple's profits in the U.S. are subject to a combined state and federal statutory tax rate of 39.1% that is the developed world's highest. Corporate taxation is so heavy in the U.S. relative to other countries that even while enjoying its near-zero rate in Ireland, Apple ends up with roughly the same overall effective tax rate, 14%, as South Korea's Samsung, its main global competitor.

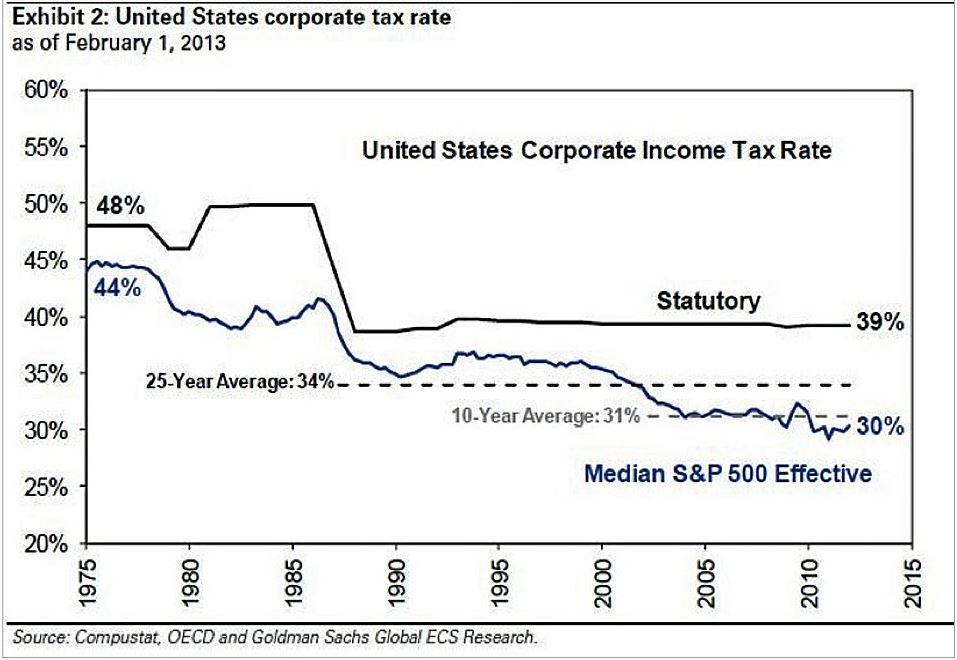

The editorial cites statutory instead of effective tax rates for a reason. While the U.S. may rank among the world's highest in statutory corporate tax rates, what corporations typically pay is substantially lower. According to Goldman Sachs' David Kostin, in the last 45 years, the median S&P 500 firm has paid a tax rate that is substantially lower than the statutory rate due to special tax preferences, subsidies, and loopholes. Furthermore, most recent data suggest that the median firm pays an effective tax rate of 30 percent -- a full 9 percentage points below the statutory rate:

And according to the Wall Street Journal's own reporting, in FY2011, corporate tax receipts as a share of profits fell to their lowest level in 40 years. Indeed, as ThinkProgress notes, even as corporate profits have hit a 60-year high, the tax burden on U.S. corporations has hit a historic low. Furthermore, in recent years, corporate tax receipts as a percentage of total government revenue have significantly declined:

The Journal's claim that corporate taxation in the U.S. is high because of its statutory rate relative to the rest of the world also doesn't stand up to scrutiny. According to Citizens for Tax Justice, citing U.S. statutory rates in comparison to other countries is inherently misleading:

Many corporate leaders have noted that other OECD countries have lowered their corporate tax rates in recent years, but fail to mention that these countries have also closed corporate tax loopholes while the U.S. has expanded them. As a result, the U.S. collects less corporate taxes as a share of GDP than all but one of the 26 OECD countries for which data are available.

While there is broad bipartisan support for reforming the corporate tax code, The Wall Street Journal's misleading portrayal of corporate taxes stacks the deck in favor of corporations lowering their historically low tax burden.